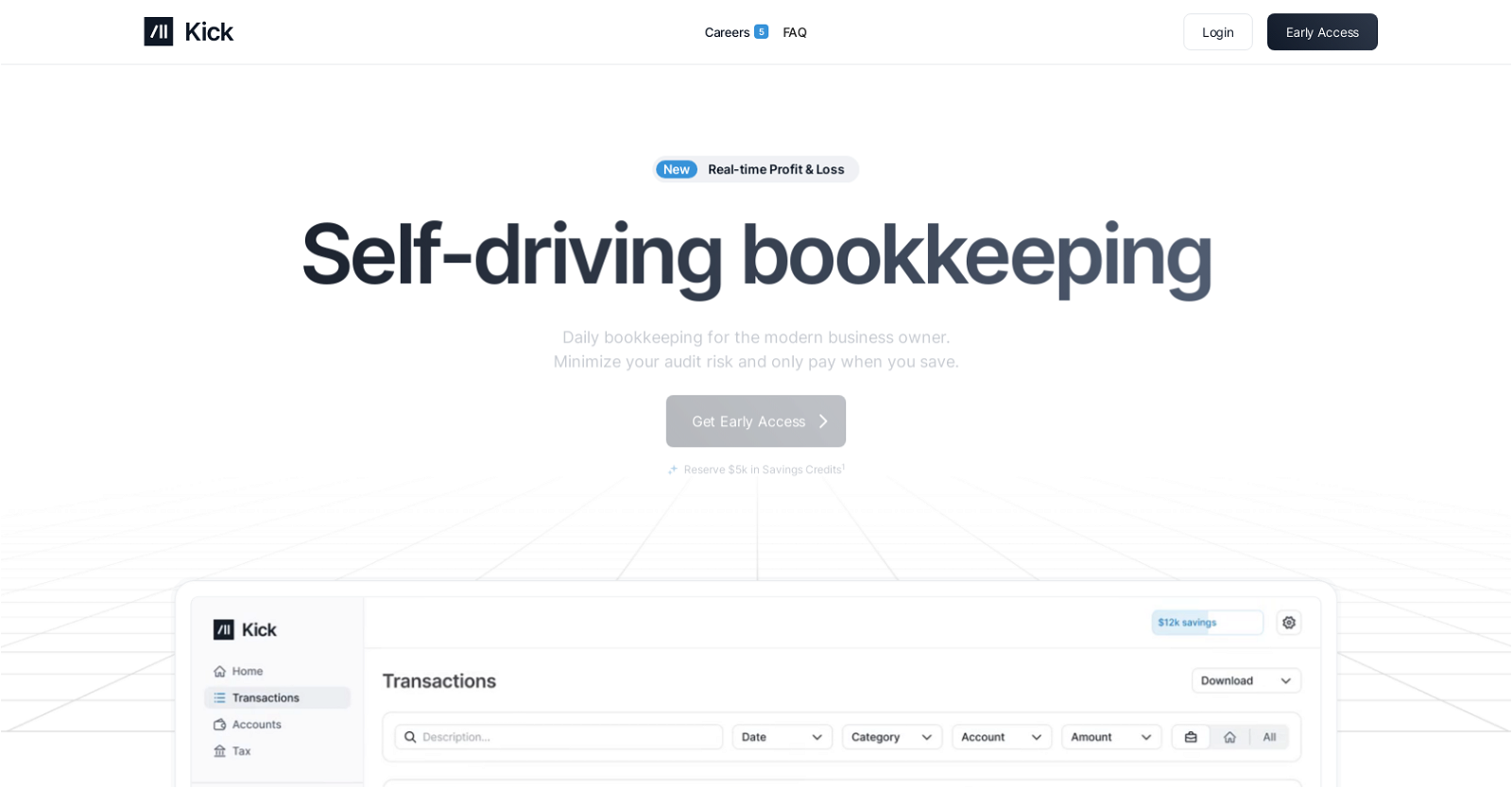

Kick | Self-Driving Bookkeeping is an AI tool designed for modern business owners to handle their daily bookkeeping efficiently and minimize audit risk.. It offers real-time profit and loss analysis, allowing users to track their financial standing across all accounts and entities. The tool provides auto-categorization of business transactions, which are reviewed by an expert for accuracy.. It also offers personalization, adapting to any changes made by the user. Kick AI eliminates the hassle of manual receipt matching by automating the process.. It ensures that no deductions are missed, including commonly overlooked expenses like home office, vehicle, and travel. Kick | Self-Driving Bookkeeping provides financial confidence by offering real-time and accountant-approved insights into profitability.. It enables users to monitor spending and cut unnecessary expenses, providing a high-level view across all entities and accounts at no additional cost.. The tool has been praised by numerous business owners for its effectiveness, simplifying their finances and saving them significant amounts of money. Kick prioritizes data security, with verified data security measures and encryption comparable to leading financial institutions.. Joining Kick | Self-Driving Bookkeeping allows business owners to focus on growing their businesses while knowing that their financial data is protected.. Early access to the tool can be reserved, with the opportunity to receive $5,000 in savings credits. The Kick Visa Debit Card, issued by Blue Ridge Bank, is also available for use with the tool.. Please note that certain details, such as the specific amount of savings and the bank partnership, may vary and are subject to change..